2023-2024 Tax Planning Guides

CPA Firm Marketing Tools

2023 Tax Pocket Tables

CPA Firm Marketing Tools

2023 - 2024 Financial Planning Guide

Firm Marketing Tools

Order by August 31, 2023 and receive a 10% discount on PRINTED Tax and Financial Planning Guides

Featured products

-

Large Tax Planning Guide

Regular price From $3.45 USDRegular priceUnit price / per -

9x12 Envelope For Large Tax Planning Guide

Regular price $0.58 USDRegular priceUnit price / per -

Small Tax Planning Guide

Regular price From $3.10 USDRegular priceUnit price / per -

#10 Envelope For Small Tax Planning Guide

Regular price $0.43 USDRegular priceUnit price / per -

Printing Options for Tax Planning Guide Inside Covers

Regular price $0.30 USDRegular priceUnit price / per -

Financial Planning Guide

Regular price From $3.45 USDRegular priceUnit price / per -

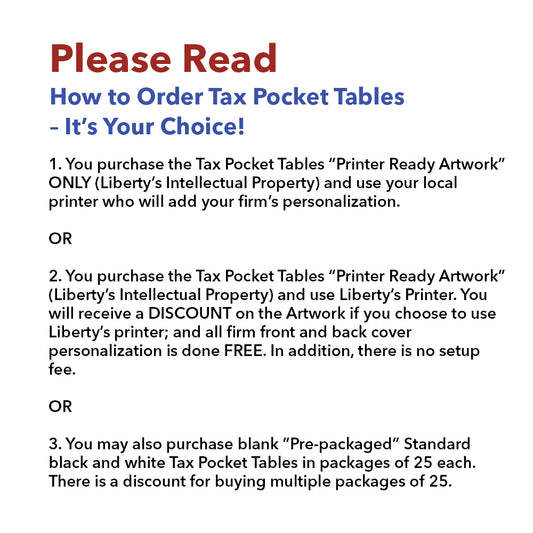

Standard Tax Pocket Tables

Regular price From $1.15 USDRegular priceUnit price / per -

Tax Planning Guide “Page Turning” PDFs Without Printed Guides

Regular price From $499.00 USDRegular priceUnit price / per

1

/

of

8

Subscribe to our Free Tax Newsletter

Be the first to know about new collections and exclusive offers.